US Light Vehicle Sales to mark first YOY gain in 12 months, according to S&P Global Mobility projection.

S&P Global Mobility US light vehicle sales estimates for the month of August 2022. S&P Global Mobility will be reporting these highlights monthly moving forward.

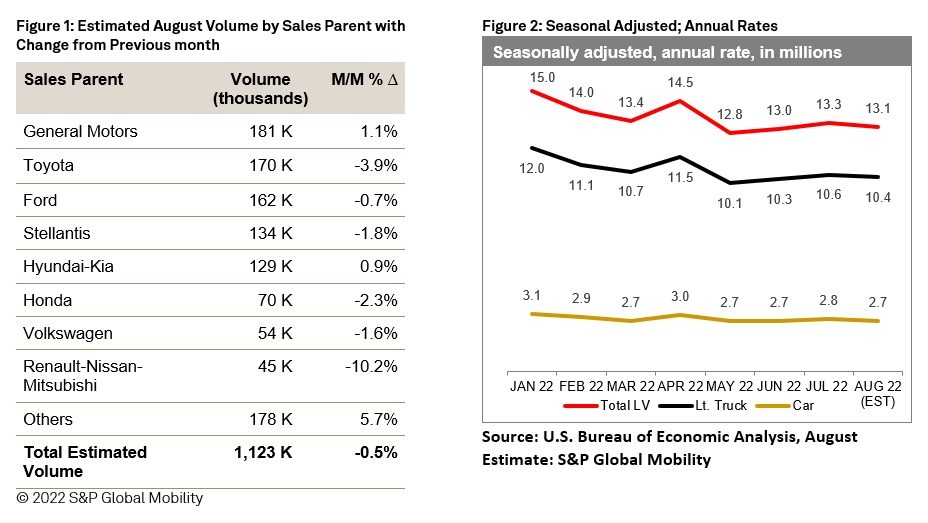

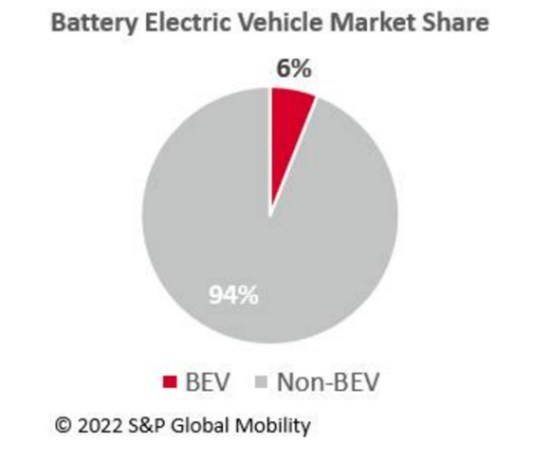

SOUTHFIELD, Mich., Aug. 26, 2022 – S&P Global Mobility’s analyst team is predicting the first year-over-year gain for new light-vehicle sales for the trailing year — with an estimate of 1.123 million units, equivalent to a 13.1 million seasonally adjusted annual rate. Moreover, the increasing consumer acceptance of electric vehicles shows it to be an increasingly important segment of the market, comprising 6.0% of the market in August. S&P Global Mobility forecasts that the rising BEV sales trend will continue. However, the overall August results are unlikely to signal an easing of challenges facing the beleaguered automotive industry. Constrained inventories, stemming from continued supply disruptions, preventing sales from rebounding more aggressively. At the same time, S&P Global Mobility sees increasing economic uncertainty crimping fourth-quarter consumer demand. Double-digit increases in new-vehicle prices are likely weighing on consumers’ willingness to enter the market.

As a result, we believe US auto sales will be limited to a 14.1 million unit total for the year, a downgrade from the 2022 14.6 million unit calendar-year forecast that the S&P Global Mobility team published in July. On a manufacturer level, August results are expected to reflect the prevailing market conditions: Potential for slight month-over-month share advancement for OEMs that have available supply to sustain sales levels, compared to continued retrenchment for OEMs struggling from an inventory standpoint.

Electric vehicle mix reflecting strong momentum

Battery electric vehicles (BEVs) are expected to reach 6.0% of light vehicle sales in August, compared to a share of 3.3% mix level in August 2021. With new model launches and continued high gas prices despite recent easing, we expect a mix of approximately 6% to be the new floor for BEVs going forward. According to S&P Global Mobility new registration data, BEV sales surged to 6.6% of total light vehicle sales volume in June 2022, its highest monthly share level ever. However, BEVs are subject to the same supply chain, labor, and logistics issues as their non-electric counterparts, as well as the sector still in a position of ramping up capacity versus established non-EV capacity. Therefore, although momentum is expected to be sustained, monthly share of EVs could be subject to volatility in the near and medium term.

S&P Global Mobility sub-segment mix

Sport-utility vehicle sales continue to rise at expense of passenger cars, specifically against sedan and hatchback. SUV mix is expected to reach more than 55% of August sales volume, up from 53.6% a year ago, and a 54.7% reading from the month prior. Pickup mix is expected to remain above 20% for the third consecutive month as new entrants are supporting the segment’s strong share. Contributing to the ongoing car decline has been reduced model offerings and throttling back of production, a result of automakers funneling scarce supplies to more lucrative sport-utilities and trucks.