Worldwide Telecommunications Services Market Saw Higher than Expected Growth in 2021, But the Future is Shadowed by the Looming Economic Slowdown, According to IDC.

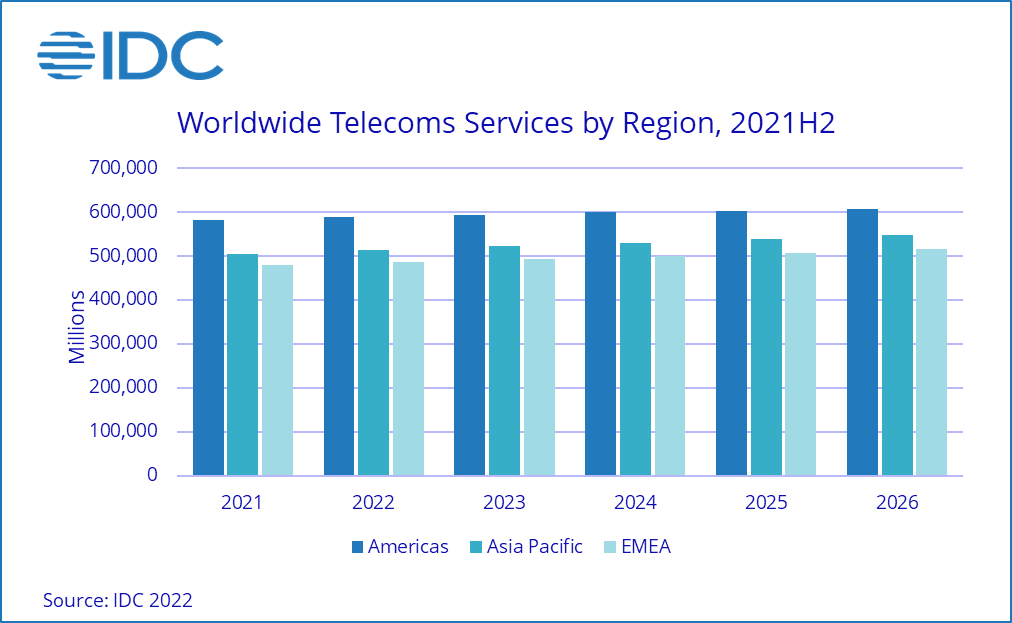

NEEDHAM, Mass – Worldwide spending on Telecom Services and Pay TV Services reached $1.566 billion in 2021, an increase of 1.6% year over year, according to the International Data Corporation (IDC) Worldwide Semiannual Telecom Services Tracker. IDC expects worldwide spending on telecom and pay-TV services to increase by 1.4% in 2022 and reach a total of $1,588 billion.

2021 was characterized by the quick recovery of the global economy from the slump caused by the COVID-19 pandemic. This favorable environment resulted in additional spending growth on telecommunications services, so the total value of the worldwide market increased slightly faster than originally forecast. This trend was common for all global regions: Europe, Middle East, and Africa (EMEA) market grew 0.2 percentage points faster than forecast in October 2021; Asia/Pacific grew 0.5 percentage points faster, and the Americas grew 1.0 percentage points faster. The higher-than-expected growth was also recorded in all technology segments except for Pay TV, which is logical because people were able to spend more time outside of their homes and therefore some decided to cancel subscriptions to TV packages acquired during the lockdowns.

| Global Region | 2020 Revenue | 2021 Revenue | 2021/2020 Growth |

| Americas | $574 | $582 | 1.5% |

| Asia/Pacific | $494 | $505 | 2.1% |

| EMEA | $474 | $479 | 1.1% |

| Grand Total | $1,541 | $1,566 | 1.6% |

IDC’s October 2021 forecast for the worldwide Telecom Services and Pay TV market included a scenario of further recovery (i.e., even higher growth rates) in the years 2022 and 2023. However, because of new circumstances that include accelerated inflation and the raising of benchmark interest rates by the central banks that will consequently lead to slower economic growth in the years to come, the forecast has been changed. The new forecast is still optimistic, but the growth rates in its first half will be lower than what was recorded last year.

Inflation should nominally have a positive impact on this market: the operators will be increasing their tariffs, clients will be paying more, and the total value of the market should be growing faster than previously expected. However, inflation also generates a deterioration of consumers’ and businesses’ purchasing power, thus causing a decrease in demand. It is to be noted that the impact of inflation in the telco services market will be stretched over the next several years. This is because a high proportion of users have two-year contracts with operators that guarantee stable fees until their contracts expire. That also means that the effects of inflation will initially be higher in the markets with a higher proportion of prepaid customers.

War in Ukraine will have a negative effect on the market for communications services in EMEA. It will primarily hit the Ukrainian market, which will see a considerable decline due to destroyed network infrastructure and a huge number of people leaving the country. The Russian market will also decline as local demand will be under pressure due to the recession caused by international sanctions. On the other hand, the war will positively impact the markets of neighboring countries (Poland, Slovakia, and Romania) that are hosting large numbers of Ukrainian refugees.

In addition, the COVID-19 saga has not ended yet. The current lockdowns in China and possible emergence of new variants of the virus in the rest of the world might bring additional impacts to the market, primarily in the business fixed data services section. Although the previous waves of COVID did not drastically affect the global market for telecom services, the related global supply-chain disruptions are already causing shortages of end-user and network equipment and thus creating new concerns for supply-side participants. This all contributes to IDC’s conservative forecast.